As published to The Huffington Post

A new study published in an article by Pulitzer Prize-winning investigative reporterGary Cohn, are based on the research of former Harvard economist William Lazonick. Lazonick examines how large, publicly traded companies spending a significant portion of their net income on stock buybacks instead of reinvestment, may be exacerbating America’s economic inequality. .

Income Inequality and Stock Buybacks

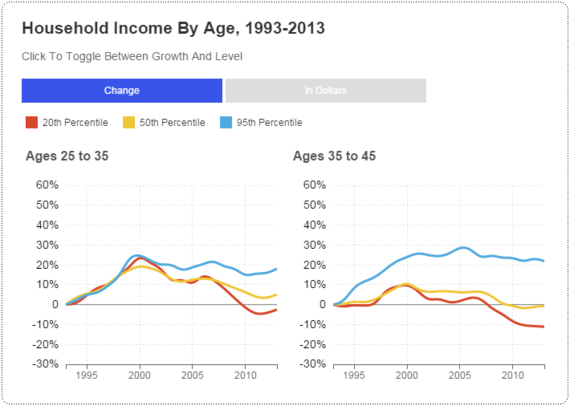

Low rates of corporate investment are associated with high rates of unemployment, and Cohn and Lazonick explore how a handful of California headquartered giants are contributing to our crisis. NPR offers a great interactive chart demonstrating the income inequality trends. Income (adjusted for inflation) grew merely 9 percent for households at the 60th percentile, 22 percent for those at the 80th percentile, but 36 percent for those at the 95th percentile.

Big companies aren’t reinvesting, in part, because of how CEO performance is evaluated. Compensation packages of corporate chief executives are linked directly to the stock value, and stock buybacks mean stock control. Control makes for value.

But it wasn’t always this way. The share of national income reinvested has been declining since the beginning of what DollarsandSense.org calls the “neoliberal” era, around 1979-1980.

California Culpability

And who’s doing this? Some of the biggest culprits are California tech companies.Cisco Systems, the San Jose technology company, devoted 110 percent of its net income to stock repurchases and dividends from 2004 to 2103. Last summer thecompany announced it was laying off up to eight percent of its workforce, even though the company has returned $13.3 billion in total to shareholders in the past four quarters alone.

Hewlett-Packard devoted 168 percent of its net income to stock repurchases and dividends from 2004-2013. In 2014 HP began laying off 50,000 employees in advance of splitting itself into two companies.

Intel, one of the world’s largest semiconductor chip makers and a company I worked for, is responsible, as well. It, too, devoted 107 percent of its net income to stock repurchases and dividends from 2004-2013. Despite CEO Craig R. Barrett committing the company would “make massive, coordinated U.S. research effort involving academia, industry, and state and federal governments to ensure that America continues to be the world leader in information technology,” the company didn’t.

Redwood City-based IT giant, Oracle, devoted 72 percent of its net income to stock repurchases and dividends from 2004-2013.

Lastly, while not technology-based, Chevron, the No. 2 U.S. oil producer, headquartered in San Ramon, devoted 49 percent of its net income to stock repurchases and dividends from 2004-2013, and repurchased $5 billion worth of its shares in 2014.

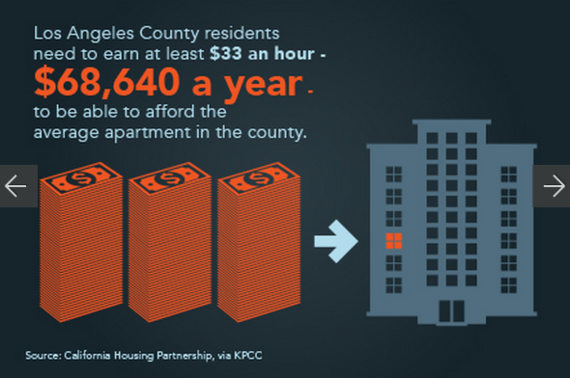

The authors argue California’s deepening economic inequality is aggravating many of the state’s biggest problems, like affordable housing and education. And all this is jeopardizing the quality of life for California residents.

(Click for full slide deck)

(Click for full slide deck)

Is There a Business Obligation to Society?

Which begs the question: is it is really the responsibility of big business to help preserve a state’s income equality, affordable housing, and quality of life? There’s no clear answer. But if you’re Peter Drucker-inspired, the answer is “yes.”

@djaa_dja @Lazonick @nikluac @TheGRLI @umairh Business has a license from society and is part of society – Drucker was very clear on this.

— Richard Straub (@rstraub46) February 19, 2015