By Patricia Baronowski-Schneider, President of Pristine Advisers.

On Wall Street, there is a great deal of communication – but little conversation. There are pundits and analysts aplenty, as well as a surplus of investment fund managers and financial experts. And yet, these men and women – the very people who need and want to attract new investors – are, for the most part, silent when it comes to social media in general and investor relations in particular.

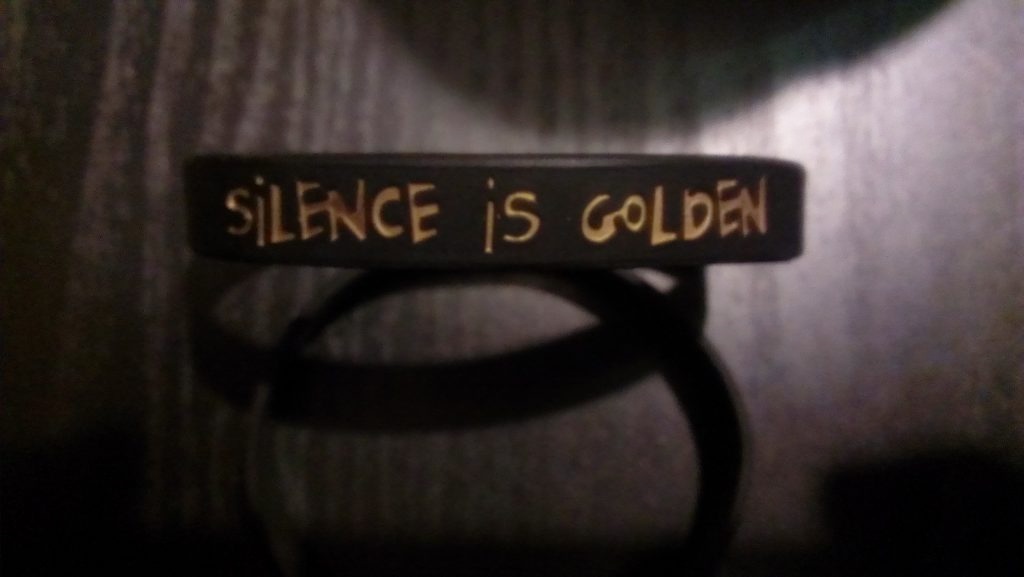

In an age of constant information, where rumors circulate instantly and innuendo spreads like one huge global conflagration, silence is neither good nor golden; it is, instead, a sign of inaction, of the apparent indifference (by fund managers and executives) to crisis, volatility and rampant speculation.

A single tweet can be the catalyst for this upheaval, sending an otherwise solid fund on a rapid descent and a series of withdrawals from investors. Notice that truth has nothing to do with this scenario, while the absence of it – along with the silence of those who can tell the real story – fuels this fire, making it an uncontrollable storm that can harm innocents at home and abroad.

I write these words from experience because, in my role as President of Pristine Advisers, I understand how potent social media is – and how responsive fund managers should be to this platform.

I also recognize that compliance officers have an important say in this dialogue, or the creation of any and all responses to the circumstances described above.

I am, however, adamant that inaction is not a smart or an effective strategy: It is an invitation for the transmission of more lies and misnomers, more inaccuracies and unjust commentary.

It is the delicacy of the financial markets that makes social media so relevant because, when individuals can make unsubstantiated assertions, when these claims go unanswered and when these statements become a near-permanent fixture of search engine results for this or that fund – when these things happen, it is very hard to erase the graffiti of the Web with a retraction or words of an expression of contrition.

So, yes, social media is an essential part of financial conversation. The consequences are too severe, and the reasons for action are too many, for fund managers to not have a plan of how to address this audience.

All of which brings us to that final and critical point: The urgency of what to say, and how to say it, because crafting a message that resonates with readers and investors alike takes time, deliberation and a professional approach to an extremely sensitive subject.

Social media is about an ongoing conversation with a group of individuals. It is about transparency, and the ability to communicate with confidence and credibility. It is about establishing trust through full disclosure, and building relationships by answering questions and respecting people’s concerns.

That conversation should be an investment fund manager’s top priority, lest he fall victim to a maelstrom of confusion and negativity.

Let us start this conversation, with optimism and clarity.

Let the dialogue begin.